Controller of Budget flags rising debt as first quarter repayments hit Sh507 billion

The jump in debt service has tightened available funds for development projects. Spending on development during the three months stood at Sh132.5 billion, roughly a quarter of the amount spent on debt.

Kenya’s government spent Sh507.98 billion on public debt in the first three months of the 2025/2026 fiscal year, marking a historic high for a single quarter.

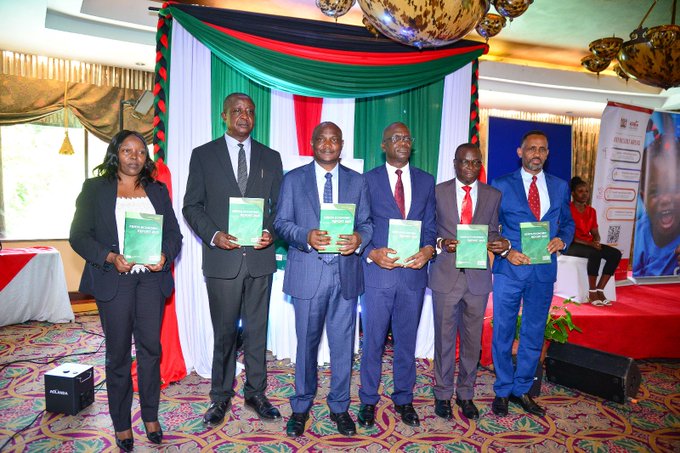

This is an increase of Sh182.5 billion compared to Sh325.52 billion spent over the same period last year, signalling growing pressure on the National Treasury as it cleared both domestic and external loans, according to a report from the Controller of Budget (CoB), Margaret Nyakang’o.

More To Read

- Key offices spent nearly all budgets but delivered little, parliamentary review finds

- Treasury eyes restructuring as Sh137 billion water sector debt stalls

- National Infrastructure Fund ‘90 per cent borrowing off the books’, Ndindi Nyoro claims

- Treasury sanctions Sh43.5 billion in unplanned spending in first quarter, budget watchdog says

- County governments turn to banks as short-term debt hits Sh3.2 billion

- Treasury: Kenya can no longer rely on taxes or borrowing for big infrastructure projects

“Total expenditure on public debt in the first three months of FY [fiscal year] 2025/2026 amounted to Sh507.98 billion, representing 27 per cent of the revised estimates, compared to Sh325.52 billion (17 per cent) recorded in a similar period of FY 2024/2025,” Nyakang’o said.

The jump in debt service has tightened available funds for development projects. Spending on development during the three months stood at Sh132.5 billion, roughly a quarter of the amount spent on debt.

The quarter’s debt payments were nearly 17 times what the government used for housing and 29 times the Sh17.3 billion allocated for road construction, the two sectors receiving the largest development funding.

Nyakang’o explained that the increase was mainly driven by principal repayments on both domestic and external obligations.

“The government retired debt valued at Sh251.8 billion during the quarter, more than double the Sh95.5 billion repaid in the same quarter of 2024,” she said.

The total debt service represents the highest quarterly payment ever recorded, even as the public debt stock continues to climb.

External debt payments reached Sh213.09 billion, including Sh141.1 billion for principal, Sh71.68 billion for interest, Sh255.37 million in commitment fees, and Sh50.28 million in other charges.

Payments to commercial banks made up the bulk of external debt service, with Sh69.9 billion going toward principal and Sh41.8 billion covering interest. Bilateral loans accounted for Sh77 billion, including Sh58.4 billion for principal repayments, representing 41.3 per cent of external principal payments.

On the domestic side, the Treasury spent Sh294.9 billion, with interest payments surpassing principal repayments.

Domestic interest amounted to Sh184.2 billion, while Sh110.7 billion was used to settle principal obligations. The domestic debt service included payments on treasury bills, bonds, overdrafts, and commissions to the Central Bank.

During this period, Kenya’s total public debt reached Sh12.04 trillion, up Sh240 billion from June. Domestic debt makes up 55 per cent of the total, while external debt slightly declined after principal repayments.

“The public debt stock increased by 2 per cent from Sh11.8 trillion as of 30 June 2025 to Sh12.04 trillion as of 30 September 2025. External debt declined by 2 per cent due to repayments, while domestic debt recorded 5 per cent growth attributable to increased borrowing in the domestic market,” Nyakang’o said.

For the full fiscal year, the government has allocated Sh1.9 trillion for debt servicing, compared with Sh1.74 trillion in the previous year.

Top Stories Today